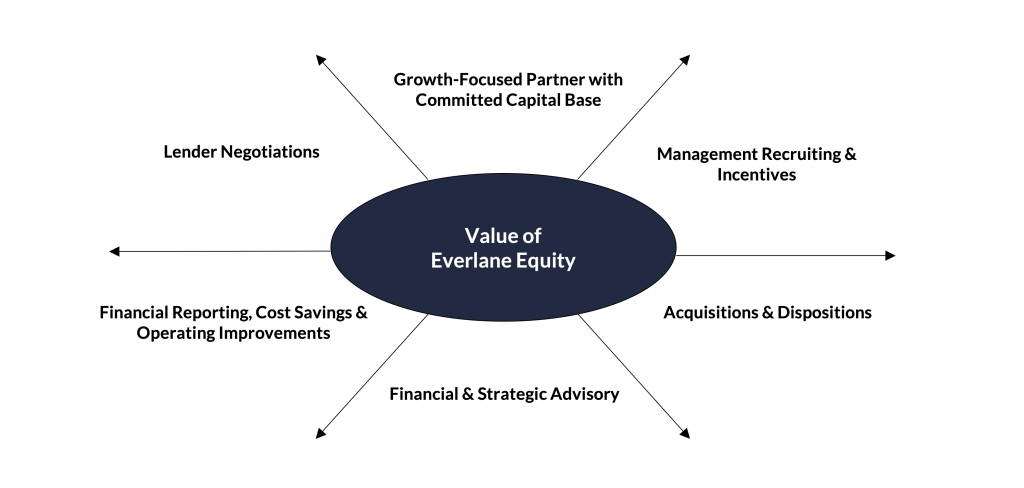

Approach

What we bring to our partners

Everlane Equity Partners manages a fully committed pool of capital. We intentionally manage a concentrated portfolio, allowing us to dedicate more time and resources to each investment and partnership.

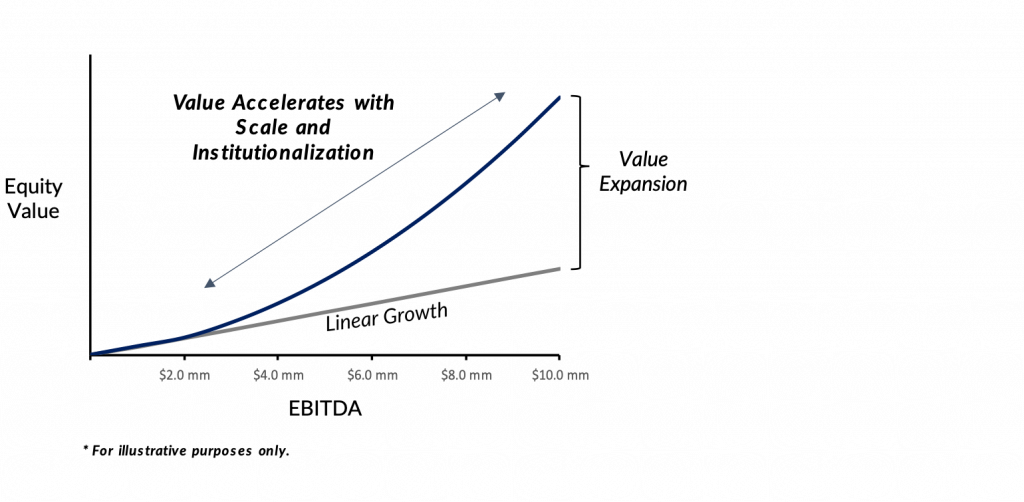

Our Focus is to Accelerate Equity Value Beyond the Linear Growth Curve

Increased scale and diversification via acquisition and organic growth

- More comprehensive offering of core specialties

- Broader coverage of customer segments and geographic markets

Institutionalization

- Build out administrative / back-office platform that can be leveraged across the enterprise as it scales; corporate team – Head of Sales, CFO, HR, etc.

- Establish processes and procedures that demonstrate the ability to maintain quality offering with efficiencies across a larger organization

- Implement systems, reporting capabilities, budgeting, metrics tracking, etc.

Commitment to our partners

Certainty of execution

- Everlane invests from a primarily institutional and fully committed capital base, bringing certainty and capital resources that will support accelerated growth for each business

- Full discretion over the investment fund brings speed and certainty to each transaction

- Flexible approach when structuring deals to achieve the transaction objectives for all shareholders

Proven history of accelerating value creation for our partners and investments

- Strengthen the business’ infrastructure with investments in people, technologies, facilities, etc.

- Add management breadth and depth, as needed, by assisting with executive recruitment to build and strengthen the overall organization (e.g., operations, sales, finance, etc.)

- Implement procedures and processes that institutionalize the business, such as detailed financial reporting capabilities and controls

- Build and execute an acquisition strategy that expands the company’s competitive strengths – Everlane resources support companies by identifying, vetting, closing and integrating acquisition targets in conjunction with company management

- Position company for future recapitalization with or sale to a larger financial buyer or strategic acquirer

Extensive experience investing in and growing companies

- Everlane’s senior team members devote full attention to our partnerships

- We are as involved as management desires

Objectives for initial transaction

- Deliver meaningful liquidity event for shareholders today, allowing them to de-risk and diversify assets

- Provide growth capital to execute strategies intended to accelerate future growth

- Provide operating partner shareholders with a significant ownership position and upside post-transaction

- Management shareholders maintain day-to-day control of their business

- Remain independent rather than being tucked within a larger organization

- Partnership creates the “ground floor” platform company where owner-operators can achieve maximum value creation with increased scale and institutionalization of the platform